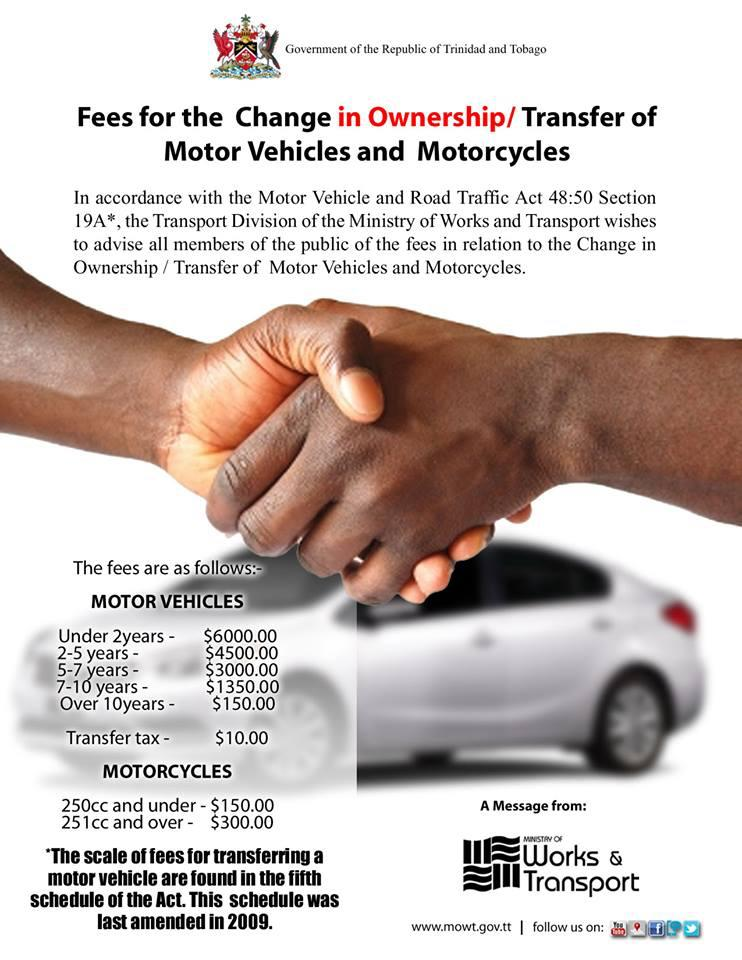

When selling or transferring the ownership of a vehicle in Trinidad and Tobago, certain fees and taxes must be paid as part of the legal process. These fees are mandated by the Motor Vehicle and Road Traffic Act 48:50, specifically outlined in Section 19A. Understanding these costs is crucial for both the buyer and the seller to ensure a smooth and legal transfer of vehicle ownership.

Fees for Motor Vehicles

The fees for transferring ownership of a motor vehicle are based on the age of the vehicle:

- Vehicles Under 2 Years: $6000.00 TTD

- Vehicles 2-5 Years: $4500.00 TTD

- Vehicles 5-7 Years: $3000.00 TTD

- Vehicles 7-10 Years: $1350.00 TTD

- Vehicles Over 10 Years: $150.00 TTD

- Transfer Tax: An additional transfer tax of $10.00 TTD is applicable for all motor vehicle transfers.

Fees for Motorcycles

The fees for transferring ownership of motorcycles are based on the engine capacity (measured in cubic centimeters - cc):

- 250cc and Under: $150.00 TTD

- 251cc and Over: $300.00 TTD

Important Notes:

- The fees for transferring a motor vehicle are stipulated in the fifth schedule of the Motor Vehicle and Road Traffic Act and were last amended in 2009.

- These fees must be paid at the Transport Division of the Ministry of Works and Transport when processing the transfer of ownership.

- It is important for both the buyer and seller to be aware of these costs as they are mandatory and failure to comply can result in delays or legal complications in the transfer process.

Additional Considerations

- Documentary Requirements: When transferring a vehicle, you will also need to submit the relevant documentation, including the completed transfer form, proof of insurance, and valid ID. Ensure all documents are up-to-date to avoid any issues during the transfer.

- Transfer Process: Both the buyer and the seller must be present at the Transport Division or authorized agents to complete the transfer process. In some cases, a power of attorney may be used if one party cannot be present.

- Vehicle Inspection: For vehicles of certain ages or conditions, a vehicle inspection may be required as part of the transfer process to ensure roadworthiness.

By understanding and preparing for these fees and taxes, the process of selling or transferring a vehicle in Trinidad and Tobago can be carried out smoothly and efficiently.

For More Information: